4th September 2025BY Nihang Law

What Is a Land Transfer Tax and How Is It Calculated?

When buying a home in Ontario, most people budget for the down payment, mortgage, and moving expenses. However, one cost that often catches buyers off guard is the Land Transfer Tax (LTT). This is a mandatory tax that buyers must pay when a property changes ownership.

Because it can amount to thousands of dollars, understanding how the tax is calculated — and whether you qualify for a rebate — is essential to planning your home purchase.

What Is a Land Transfer Tax?

Land Transfer Tax is a provincial tax charged every time real estate ownership changes hands in Ontario. Unlike property tax, which is paid annually, LTT is a one-time payment due at the time of closing.

- Who pays land transfer tax in Ontario? The buyer of the property is responsible, not the seller.

- When is land transfer tax paid? It is paid on the closing date, through your lawyer.

- What does it apply to? All real estate transactions, including residential homes, commercial properties, and vacant land.

In addition to Ontario’s provincial LTT, the City of Toronto charges its own Municipal Land Transfer Tax (MLTT). This means that Toronto homebuyers pay both provincial and municipal land transfer taxes.

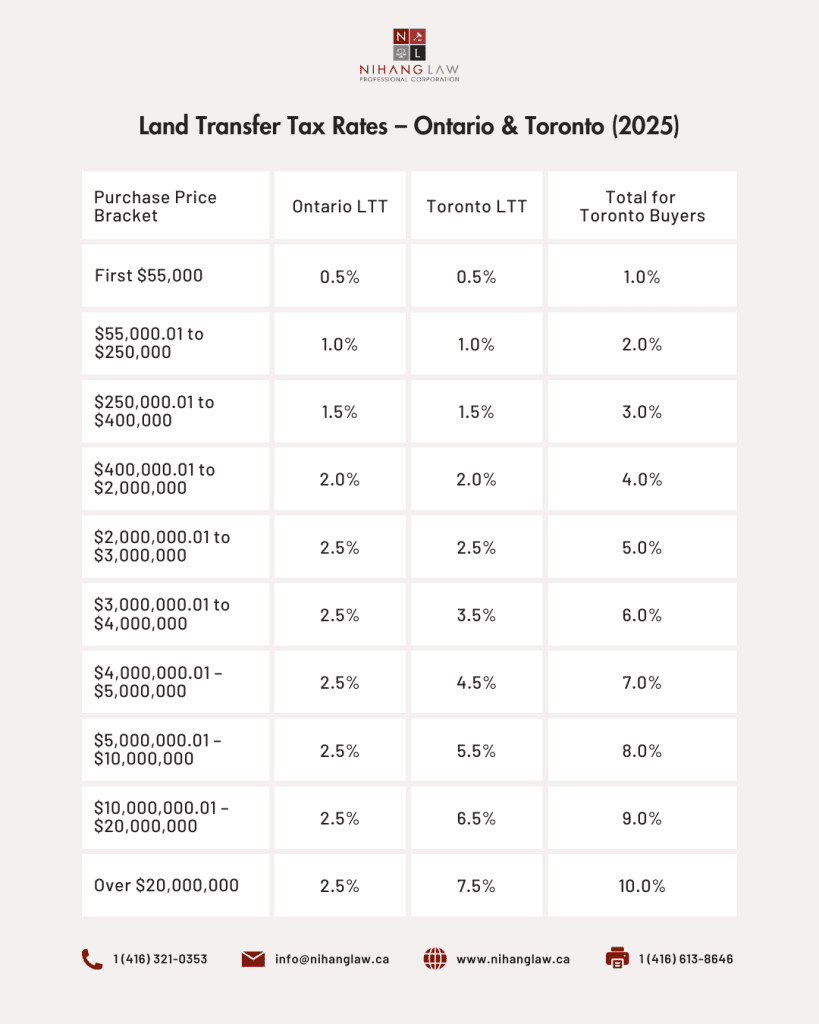

How Is Land Transfer Tax Calculated?

Ontario uses a marginal or tiered tax system, where each portion of the purchase price falls into a different tax bracket. The tax is not applied uniformly to the total price but rather calculated incrementally across the brackets.

Additional Toronto LTT Surtax Brackets

The City of Toronto has introduced higher MLTT rates for luxury properties above $3 million. Buyers in this range should consult legal counsel for the most current tax calculations.

Example: Buying a $600,000 Home in Toronto

How to Compute:

Provincial Land Transfer Tax (Ontario)

Ontario’s tiered rates apply to different portions of the purchase price:

0.5% on the first $55,000 → $55,000 × 0.005 = $275

1.0% on $55,000.01 – $250,000 → ($250,000 – $55,000) × 0.01 = $195,000 × 0.01 = $1,950

1.5% on $250,000.01 – $400,000 → ($400,000 – $250,000) × 0.015 = $150,000 × 0.015 = $2,250

2.0% on $400,000.01 – $600,000 → ($600,000 – $400,000) × 0.02 = $200,000 × 0.02 = $4,000

Total Provincial LTT = $275 + $1,950 + $2,250 + $4,000 = $8,475

Municipal Land Transfer Tax (Toronto)

Toronto charges the same tiered structure as Ontario, so the calculation is identical:

0.5% on the first $55,000 → $275

1.0% on $55,000.01 – $250,000 → $1,950

1.5% on $250,000.01 – $400,000 → $2,250

2.0% on $400,000.01 – $600,000 → $4,000

Total Municipal LTT = $8,475

Total Land Transfer Tax (Before Rebates)

Provincial: $8,475

Municipal: $8,475

Total = $16,950

This amount is due upfront upon closing and cannot be rolled into your mortgage.

Rebates and Exemptions

To help ease the burden for new buyers, both Ontario and Toronto offer rebates.

- Ontario First-Time Home Buyer Rebate: Up to $4,000 off provincial LTT.

- Toronto First-Time Home Buyer Rebate: Up to $4,475 off municipal LTT.

- Eligibility: You must be at least 18, have never owned a home anywhere in the world, and the property must be your principal residence within 9 months of purchase.

Lawyers usually apply for these rebates on behalf of buyers at the time of closing.

Exemptions

Ontario law provides certain exemptions from LTT, including:

Family transfers of farmed land (Reg. 697/91), provided the land continues to be used for farming.

Estate transfers of farmed land to family members, where farming intent continues.

Transfers to a family business corporation meeting prescribed income and activity tests; affidavits and security may be required.

Spousal or common-law partner transfers, which may qualify for rollover treatment (Reg. 696/90).

Partnership de minimis exemption (Reg. 70/91), where a partner’s profit share increases by no more than 5% in a fiscal year (with limits introduced in 2016).

Important: While gifts between spouses or parents and children may avoid LTT if no consideration or debt is involved, they are not automatically exempt, especially if a mortgage or other liability is assumed. Always consult a real estate lawyer to determine whether your transfer qualifies.

Non-Resident Speculation Tax (NRST)

In addition to LTT, non-resident buyers of residential property in Ontario may be subject to the Non-Resident Speculation Tax (NRST) at 25% of the purchase price. This applies to foreign individuals, foreign corporations, and taxable trustees purchasing certain residential properties. The NRST is a separate tax from LTT and is payable at closing.

Why Understanding LTT Matters

- Budgeting: Since LTT is paid upfront, it’s critical to factor it into your closing costs.

- Rebates: Knowing the rules ensures you don’t miss out on thousands in potential savings.

- Planning: The additional municipal tax in Toronto can make buying outside the city more attractive.

Frequently Asked Questions

Q: Do sellers pay Land Transfer Tax?

A: No. Only buyers pay Land Transfer Tax in Ontario.

Q: Can Land Transfer Tax be added to my mortgage?

A: No. Land Transfer Tax must be paid in full on the closing date.

Q: Does LTT apply to commercial or investment properties?

A: Yes. The same tax brackets apply.

Q: When is the payment due?

A: On the closing date, handled by your lawyer.

Conclusion

Land Transfer Tax is a significant cost in Ontario real estate transactions and can amount to tens of thousands of dollars, particularly for buyers in Toronto. By understanding how it is calculated and what rebates are available, buyers can better prepare for closing and avoid unpleasant surprises.

At Nihang Law, we help clients budget accurately, apply for rebates, and ensure that every aspect of their real estate transaction runs smoothly. If you’re planning to purchase a property in Ontario, contact us today to learn how we can guide you through the process.

Thank you for reading this post, don't forget to subscribe!