If you’re expanding into Ontario or anywhere else in Canada, or scaling an existing Canadian operation, you may be thinking: “We already trust this person. They are someone who can stabilize the team, protect revenue, and execute the plan. Can we move them to Canada without an LMIA?”

That’s where an ICT LMIA-exempt work permit can fit, often filed using exemption code C62 for executives and managers.

But this is the part many businesses learn the hard way: “LMIA-exempt” doesn’t mean “paperwork-exempt.” It means you are using a different pathway under Canada’s work permit system — one that still requires the right employer process, the right role, and a clean and well-documented story.

This guide breaks down Intra-company Transfer (often called an “ICT”) in Canada with a focus on C62, the exemption that is commonly used for executives and senior managers transferring to an established Canadian business under the International Mobility Program (IMP).

Disclaimer (please read): This article is for general information only and is not legal advice. Immigration rules and officer expectations can change, and outcomes depend on your facts and documents.

Quick Start or Pick Your Situation (Checklist)

Use this as a fast “Where do I start?” tool.

Pick the situation that sounds most like yours

1. We already have an established Canadian business (active operations).

☐ You have a Canadian corporation, branch, or affiliate that is actually operating (not just incorporated)

☐ You want to transfer an executive or senior manager to run or oversee the Canadian operation

☐ You can show a real corporate relationship between the foreign company and the Canadian entity (e.g. parent, subsidiary, affiliate, or branch)

2. We’re setting up a new Canadian operation.

☐ You don’t have active operations yet (or they’re minimal)

☐ Your plan depends on a leader entering Canada to launch and build the operation

(This may point to a different intra-company category than C62. Read our blog on C61 for more information.)

Quick readiness check (either path)

☐ The employer can submit an LMIA-exempt offer of employment through IRCC’s Employer Portal (IMP).

☐ You can clearly explain why this role benefits the Canadian operation and why this person is the right fit.

☐ You can support the job duties with a real org chart + proof the Canadian business is active.

☐ The transferee has at least 1 year of continuous employment with the foreign entity (commonly within the last 3 years) in an executive or manager capacity (or is otherwise clearly eligible as per current guidance or practice).

What is C62 and How It Fits Within an ICT Work Permit?

C62 is an LMIA-exemption code commonly used for ICT executives, senior managers, and functional managers transferring to an existing Canadian operation under the International Mobility Program (IMP).

In practice, it is the code the employer selects in the IRCC Employer Portal offer of employment, and the worker uses that offer number to apply for the intra-company transfer work permit.

Two practical points to know up front:

- LMIA-exempt does not mean work-permit-exempt. In many LMIA-exempt situations, the worker still needs a work permit, and the employer must provide the LMIA exemption code in the offer of employment.

- This is typically an employer-specific work permit. That means the work permit is tied to the named employer, role, and location described in the application (with limited flexibility).

If your goal is to transfer trusted leadership into Ontario to run an existing operation as quickly as possible, an ICT employer-specific work permit using exemption code C62 may be a strong fit. But success depends on whether your facts match the category and whether your documentation would be sufficient and satisfy IRCC.

LMIA-Exempt — What It Really Means for Your Business

An LMIA (Labour Market Impact Assessment) is a labour market test used in many Temporary Foreign Worker Program cases. Under the IMP, many hires are LMIA-exempt, but the employer usually must still:

- Submit an offer of employment in the Employer Portal, and

- Pay the employer compliance fee (in most cases).

IRCC’s own guidance is clear that, when an LMIA exemption applies, the employer can hire without an LMIA, the worker typically still needs a work permit, and the employer must include the LMIA exemption code in the offer.

Who C62 is Usually Meant For (Executives and Senior Managers)

While titles can be misleading, the C62 conversation is usually about true leadership roles, such as:

- Directing a major function

- Managing senior staff and budgets

- Setting strategy and making high-level decisions

- Overseeing the Canadian operation on behalf of the multinational group

In some cases, functional manager roles may also fit where the facts support this.

What this means for you:

Officers typically look past a fancy title and ask: Do the duties match a senior or executive role in reality? Likewise, officers also look at whether the Canadian operation’s size and structure realistically support a senior leadership position (especially on extensions). Your org chart, reporting lines, and day-to-day responsibilities need to line up.

Ontario-specific practical tip:

If the person will be based in the GTA (Toronto, Mississauga, Brampton, Markham, etc.), make sure the job location, wage and seniority alignment, and day-to-day work site are consistent across the Employer Portal submission and the work permit forms. Ensure the wage is defensible for a senior or executive role. Inconsistencies could cause delays and increase refusal risk.

The Canadian Business Must Look “Real” and Operating (not just incorporated)

A common pressure point in intra-company transfer applications is proving that the Canadian entity is genuinely established and operating (doing business), not just a shell with a bank account.

While the exact evidence varies, the practical expectation is usually to show the Canadian operation has substance, such as premises, revenue activity, staff, contracts, and business continuity.

A strong “established business” package often includes:

- Proof of physical or operational presence (lease, photos, signage, insurance)

- Invoices or contracts and bank statements showing active transactions

- Payroll summaries or staff lists (as applicable)

- Corporate documents showing the relationship between entities (share structure, board resolutions, corporate profiles)

- Updated business overview: what the Canadian entity does, who it serves, and what the transferee will lead

The Employer Process (IMP): What Must Happen Before the Worker Applies

In many IMP cases, the employer needs to use IRCC’s Employer Portal and submit the offer of employment before the foreign national applies for the work permit. The portal is specifically for employers hiring workers who don’t need an LMIA.

IRCC also explains that, in most cases, to hire a temporary worker through the IMP, the employer must pay the $230 employer compliance fee and submit the offer of employment through the Employer Portal.

If the employer fails to do this, the worker-side application can be delayed or refused even if the person is genuinely qualified.

In limited scenarios, an employer may be exempt from the employer compliance fee, and in some cases may not need to use the Employer Portal. Confirm exemption status before filing.

What the Transferee Typically Prepares (The “Worker Side”)

Think of the transferee’s file as answering four questions in plain language:

- Who are you in the company group (role, seniority, history)?

- What are you doing in Canada (duties that match executive/senior manager leadership)?

- Why must it be you (why this specific leader)?

- Why is it temporary and credible (clear assignment purpose, ties, and a plan that makes business sense)?

- Evidence the assignment is temporary, and the foreign employment remains real or available (to support the ‘return’ logic of an ICT).

You’ll typically support that with:

- Detailed role description matching actual duties and reporting lines

- Resume or CV and reference letters confirming senior leadership experience

- Proof of ongoing employment with the foreign entity (and continuity)

- Org charts (foreign + Canadian) showing how the person fits

- A plain-English support letter tying the facts together

Costs to Budget (Verified Government Fees)

Government fees can change, so always confirm before filing. As of IRCC’s posted fee list, a work permit (including extensions) is C$155 per person. If biometrics are required, IRCC lists C$85 for an individual applicant. On the employer side, IRCC guidance states the employer compliance fee is C$230 in most cases for IMP hires.

Typical “known” fee line items:

- Employer compliance fee: $230

- Work permit processing fee: $155

- Biometrics (if required): $85

Other costs such as translations, couriering, corporate document preparation, and travel depend on your facts and are not “standard fees.”

Common Mistakes (and How to Avoid Them)

Using a job title instead of providing job duties

A “Director” title won’t help if the duties read like a mid-level coordinator. Your duties, org chart, and reporting lines must match a senior leadership role.

Weak proof that the Canadian business is truly operating

Incorporation documents alone often aren’t persuasive. Add real operational evidence (contracts, invoices, bank activity, premises).

Employer Portal mismatches

If the Employer Portal submission describes duties, location, or wage one way and the work permit application describes them another way, you can expect questions or delays.

Treating “LMIA-exempt” like “no employer obligations”

For many IMP hires, IRCC expects the employer to submit an offer and (in most cases) pay the compliance fee.

A vague “why Canada, why now” story

If your letters read like copy-paste templates, you lose credibility. Explain the business reason in plain English (expansion, major client delivery, operational governance, compliance, turnaround).

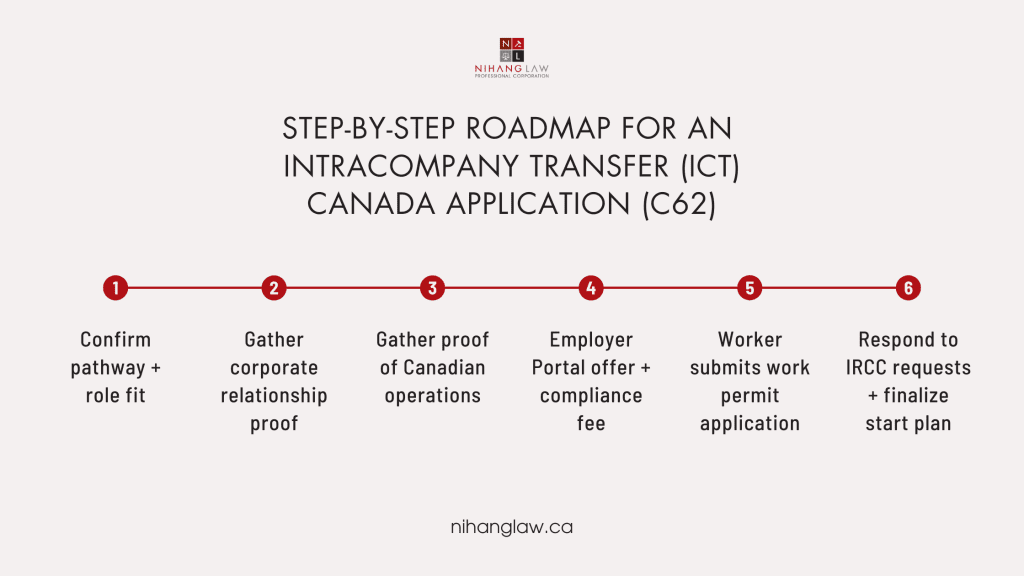

Step-by-step Roadmap (from Planning to Work Permit)

This is the sequence we usually recommend businesses follow to reduce rework.

Step 1: Confirm the correct pathway and role fit

- Clarify whether your Canadian operation is established or still being set up

- Map the proposed duties to a true executive or senior manager function

- Decide what evidence will prove this without relying on labels

Step 2: Build the corporate relationship proof

- Parent, subsidiary, affiliate, branch evidence

- Corporate profiles, share structure, key resolutions (if applicable)

Step 3: Build the “Canadian business is operating” package

- Premises or location, business activity, financial or contract proof

- Org chart and staffing plan that fits the leadership role

Step 4: Employer Portal submission (IMP)

- Submit the LMIA-exempt offer through the Employer Portal (where required)

- Pay the employer compliance fee in most cases

- Ensure the exemption selection and explanation align with the duties

Step 5: Worker application package

- Forms, supporting letters, proof of role, credentials

- Compile a clean and consistent narrative that matches the Employer Portal submission

Step 6: Submit the work permit application through the correct channel

IRCC provides separate instructions depending on where the worker is applying from (outside Canada, inside Canada, or — where eligible— at a port of entry).

Most applicants already in Canada can’t apply at a port of entry for an initial permit/extension and must apply online. Port-of-entry applications are generally limited to eligible visa-exempt travellers (and certain specific categories). Applicants who are visa-required generally can’t apply at the port of entry.

Step 7: Respond quickly if IRCC asks questions

If you receive a request letter, respond with targeted evidence that directly answers the concern—no “document dumps.”

FAQ (Questions We Frequently Get)

Is the C62 Work Permit the same thing as an “ICT”?

C62 is commonly discussed as a code used for an intra-company transfer of an executive/senior manager to an established Canadian business under the IMP. “ICT” is the general concept; the code is how it’s categorized in the process.

If it’s LMIA-exempt, do we still need to do anything as the employer?

Often, yes. In most IMP hires, the employer must submit an offer of employment through the Employer Portal and pay the $230 employer compliance fee.

Does the employee still need a work permit?

In many LMIA-exempt scenarios, yes. Where an LMIA exemption applies, the worker typically still needs a work permit, and the employer must include the exemption code in the offer.

How much are the government fees?

Common verified fees include $155 for a work permit (per person) and $85 for biometrics (if required). Employers often pay a $230 compliance fee for IMP hires.

Can the person bring their spouse or children?

Accompanying family members may be eligible for visitor records or study permits. In some cases, spouses may qualify for an open work permit, but eligibility tightened effective January 21, 2025 and depends on the principal worker’s occupation or TEER and other criteria. Dependent children are no longer eligible for an open work permit under that measure. Plan early and confirm current IRCC requirements before timing travel and school.

Can we “fix it later” if the job duties weren’t drafted well?

At times, you can clarify, but it’s risky to rely on later explanations. It’s usually better to align duties, org charts, and the Employer Portal submission from the start.

How do we show that the Canadian business is established?

Think operational proof: premises, contracts/invoices, bank activity, staff functions, and a credible business footprint—supported by clear documents.

Where do we actually apply?

IRCC’s work permit guidance depends on whether you’re applying from outside Canada, inside Canada, or (where eligible) at a port of entry. Most applicants already in Canada can’t apply at a port of entry for an initial permit/extension and must apply online.

Port-of-entry applications are generally limited to eligible visa-exempt travellers, and visa-required applicants generally can’t apply at the port of entry.

In Summary

If you’re considering an ICT work permit using the C62 code to move an executive or senior manager into an established Canadian business, alignment is key.

That means the corporate relationship must be clear, the Canadian operation must look genuinely active, and the role must read like true senior leadership in practice, not just on paper.

Because “LMIA-exempt” does not mean “paperwork-exempt,” strong documentation and consistency, especially between the Employer Portal submission and the work permit application, can make the difference between a smooth process, costly delays, or even a refusal.

If you’re planning a transfer into Canada, it’s worth getting the strategy right before you file. Therefore, the story, the job duties, and the evidence all support the same conclusion.

How Nihang Law Can Help

If you are looking to move a key leader to Canada quickly and compliantly, our team can help you build a clear and comprehensive package from start to finish. We can assist with:

- Strategy and category fit: Confirm whether C62 is the right pathway for your facts and role (and flag when another intra-company option may be a better match).

- Employer Portal support: Prepare and review the LMIA-exempt offer submission so the duties, wage approach, and location are consistent and defensible.

- Evidence packaging: Organize the corporate relationship documents and the “Canadian operations” proof into a clean, persuasive record.

- Support letters and narrative: Draft practical, plain-English explanations that connect the business need to the proposed senior leadership duties.

- Risk reduction: Identify common refusal triggers (mismatched duties, thin Canadian operations evidence, inconsistencies) before you submit.

Ready to take the next step? Contact Nihang Law Professional Corporation to discuss your intra-company transfer strategy and documentation. Call us at 416-321-0353 or visit nihanglaw.ca to schedule a consultation.

Disclaimer: This information is general only and not legal advice. Your best approach depends on your specific corporate structure, role duties, and documentation.

Thank you for reading this post, don't forget to subscribe!